The Federal Reserve (Fed) plays a critical role in steering the U.S. economy through its ability to set interest rates, which are used to influence economic growth, inflation, and employment. By adjusting the federal funds rate, the Fed can either stimulate or cool down the economy, depending on the economic conditions at the time. These decisions have wide-ranging consequences that affect not just financial markets, but also the lives of everyday Americans. In this article, we will explore how Fed rate changes influence the broader U.S. economy and shape critical factors like inflation, employment, consumer behavior, and business investment.

Understanding the Federal Funds Rate

The federal funds rate is the interest rate at which banks lend to each other overnight. While this may seem like a technical aspect of banking, it serves as a benchmark for a wide range of other interest rates, including those on consumer loans, mortgages, and business loans. By raising or lowering this rate, the Fed can influence the cost of borrowing across the entire economy.

When the Fed wants to stimulate economic growth, it lowers the federal funds rate, making borrowing cheaper for consumers and businesses. Conversely, when the economy is growing too quickly and inflation becomes a concern, the Fed raises the rate to increase borrowing costs and slow down spending. These changes in the federal funds rate have a ripple effect, influencing virtually every aspect of the U.S. economy.

Impact on Economic Growth

Fed rate changes directly impact the pace of economic growth. When interest rates are low, borrowing costs decrease, making it easier for individuals and businesses to take out loans for big-ticket items like homes, cars, or new investments. This increased access to credit stimulates spending and investment, which boosts overall economic activity.

Stimulating Growth with Lower Rates

When the economy is struggling or in a recession, the Fed typically lowers interest rates to stimulate growth. Lower rates reduce the cost of borrowing for businesses, encouraging them to invest in new projects, expand operations, or hire more workers. For consumers, lower interest rates make it cheaper to finance purchases, such as homes or cars, which increases consumer spending and helps drive economic recovery.

In this environment, sectors such as housing, retail, and manufacturing often benefit from increased demand. For example, lower mortgage rates can spur activity in the housing market, leading to more home sales and construction. Similarly, cheaper financing options for cars can boost the automotive industry, while lower business loan rates encourage expansion and hiring.

Slowing Growth with Higher Rates

On the other hand, when the economy is growing too rapidly and inflation becomes a concern, the Fed raises interest rates to slow down borrowing and spending. Higher interest rates make loans more expensive, which reduces demand for credit. As a result, consumers may delay major purchases, and businesses might scale back investments.

By raising rates, the Fed hopes to prevent the economy from overheating and to keep inflation in check. While higher rates can slow down economic growth, they are often necessary to prevent the economy from growing at an unsustainable pace, which could lead to bubbles in asset markets or excessive inflation.

Controlling Inflation Through Interest Rates

One of the Fed’s primary goals is to manage inflation, which is the rate at which prices for goods and services increase over time. Moderate inflation is considered a sign of a healthy economy, but too much inflation erodes purchasing power and can lead to economic instability. Interest rates are the Fed’s main tool for controlling inflation.

Low Rates and the Risk of Inflation

When the Fed lowers interest rates, it increases the supply of money in the economy by making borrowing cheaper and more attractive. As more money circulates, demand for goods and services rises, which can lead to higher prices if supply doesn’t keep up with demand. In this scenario, inflation can accelerate, potentially harming consumers’ purchasing power.

In a low-rate environment, inflation can become a risk if the economy grows too quickly. The Fed must carefully balance stimulating growth without allowing inflation to spiral out of control. If inflation begins to rise too fast, the Fed may need to reverse course and raise rates to cool down the economy.

Raising Rates to Combat Inflation

When inflation is rising beyond the Fed’s target (usually around 2% annually), raising interest rates becomes a tool to slow down inflationary pressures. Higher interest rates reduce the availability of cheap credit, making it more expensive for consumers and businesses to borrow and spend. As a result, demand for goods and services declines, which helps to stabilize or even lower prices.

For example, when interest rates rise, consumers may delay purchasing homes or cars due to higher financing costs. Businesses may also cut back on expansion plans or reduce inventory orders, which decreases demand for raw materials and other inputs. This reduction in demand can help lower inflation and stabilize the economy over time.

Effect on Employment and Job Creation

Interest rate changes also have a profound impact on employment levels. When the Fed lowers rates, it can boost job creation by encouraging business expansion and consumer spending. Conversely, higher rates can lead to slower job growth as businesses cut back on hiring and investments.

Boosting Employment with Lower Rates

Low interest rates are often a catalyst for job creation, as they encourage businesses to borrow and invest in growth. For instance, when companies can access cheaper loans, they are more likely to invest in new equipment, open new locations, or hire additional workers. This increased business activity translates into more jobs and lower unemployment rates.

Additionally, lower rates encourage consumer spending, which creates demand for goods and services. As businesses see higher sales, they may need to hire more employees to keep up with the increased demand. This virtuous cycle of spending and hiring can help reduce unemployment, particularly in times of economic downturn.

Higher Rates and Slower Job Growth

In contrast, higher interest rates can slow down employment growth. When borrowing costs increase, businesses may postpone expansion plans or cut back on hiring to save money. As consumer demand slows due to higher borrowing costs, companies may also scale back their workforce or freeze hiring.

While higher rates can slow job creation, the Fed’s goal is to prevent the economy from overheating, which could lead to inflation and unsustainable employment levels. By maintaining a balance between job growth and inflation, the Fed aims to create a stable economic environment that supports long-term employment.

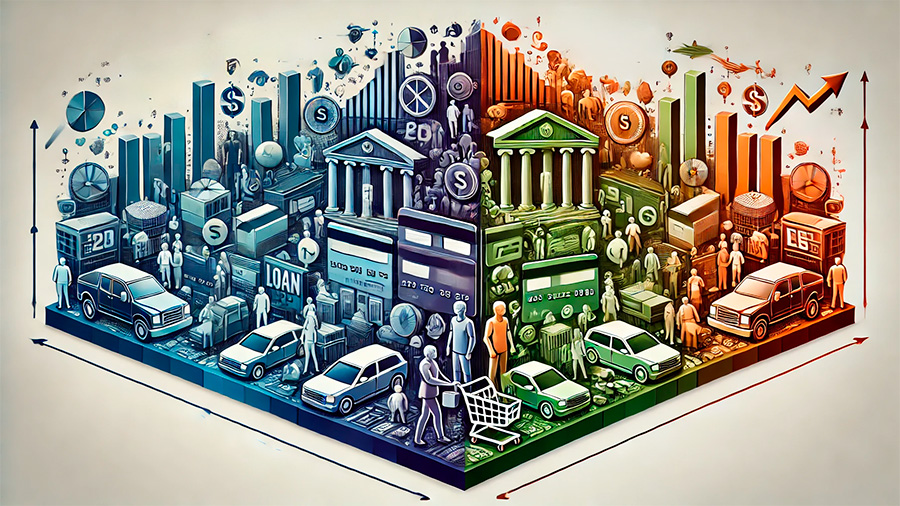

Impact on Consumer Behavior

Fed rate changes directly influence consumer behavior, particularly in how individuals approach borrowing, spending, and saving. Changes in interest rates can alter the cost of consumer loans, credit card debt, and mortgages, all of which impact household financial decisions.

Borrowing and Spending with Lower Rates

When the Fed lowers interest rates, borrowing becomes cheaper for consumers. Lower rates on mortgages, auto loans, and credit cards encourage people to take on more debt to finance big-ticket purchases. As a result, consumer spending often increases, which stimulates economic activity and boosts retail sales, housing demand, and other sectors.

For example, lower mortgage rates can lead to a surge in homebuying activity, as more people can afford to take out loans for homes. Similarly, lower interest rates on auto loans can encourage more consumers to purchase cars. This increase in consumer spending helps drive economic growth, as businesses see higher sales and may need to hire more workers to meet demand.

Saving and Spending with Higher Rates

When the Fed raises interest rates, the cost of borrowing increases, which can lead consumers to cut back on spending. Higher interest rates on credit cards and loans make it more expensive to finance purchases, leading people to delay or forgo major expenditures.

At the same time, higher interest rates provide an incentive for saving, as deposit accounts and bonds offer better returns. Consumers may choose to save more and spend less, which can slow down economic growth as demand for goods and services declines. The goal of higher rates is to curb inflation by reducing spending, but it can also slow economic activity in the short term.

Effect on Business Investment and Expansion

Businesses are highly sensitive to Fed rate changes, particularly when it comes to decisions about investing in growth and expansion. Interest rates affect the cost of capital, which in turn influences how much companies are willing to borrow and invest.

Encouraging Investment with Lower Rates

When interest rates are low, businesses can borrow more cheaply to finance expansion projects, research and development, or new hires. Lower rates reduce the cost of debt, making it more attractive for companies to take out loans for investments that can fuel growth. This can lead to increased production, innovation, and job creation.

For example, a manufacturing company may decide to build a new factory when interest rates are low, knowing that the cost of borrowing will be manageable. Similarly, tech companies may invest in new products or technologies, spurring innovation and contributing to long-term economic growth.

Reducing Business Expansion with Higher Rates

Higher interest rates make borrowing more expensive, which can lead businesses to scale back on their growth plans. When the cost of capital rises, companies may delay or cancel investments that are no longer financially viable. This reduction in business investment can slow economic growth and limit job creation.

For businesses that rely on debt to finance their operations, higher interest rates can also lead to higher operating costs, which may force companies to cut expenses elsewhere, such as reducing hiring or freezing wages. While higher rates can help prevent the economy from overheating, they can also slow business expansion and innovation.

Conclusion: Navigating the U.S. Economy Amid Fed Rate Changes

The Federal Reserve’s decisions on interest rates have profound and far-reaching effects on the broader U.S. economy. From influencing inflation and employment to shaping consumer behavior and business investment, rate changes are a powerful tool for managing economic growth. Lower rates encourage borrowing, spending, and job creation, while higher rates help control inflation by slowing economic activity.

Understanding how Fed rate changes impact various sectors of the economy can help businesses and consumers make informed decisions in a dynamic economic environment. As the Fed adjusts rates in response to evolving economic conditions, its actions will continue to play a crucial role in shaping the future of the U.S. economy.