Leasing commercial space is a significant decision for any business, and getting it right can set the foundation for growth and success. However, the process can be complex, and many businesses make costly mistakes when negotiating leases or selecting a property. Whether you’re a new business owner or looking to expand, understanding these common pitfalls and how to avoid them will help you secure a lease that meets your needs without unnecessary complications. In this article, we’ll explore the most frequent mistakes businesses make when leasing commercial premises and provide strategies to steer clear of them.

Not Understanding the Full Costs

One of the most common mistakes businesses make when leasing commercial property is underestimating the total costs involved. While the monthly rent is often the primary focus, there are many other expenses that can quickly add up and impact your budget.

Leases can come with additional costs such as:

- Maintenance Fees: Some leases, particularly triple-net (NNN) leases, require the tenant to cover property maintenance, repairs, and common area upkeep. These expenses can vary widely and should be accounted for when determining the total cost of the lease.

- Utilities and Services: In many leases, tenants are responsible for their own utilities, including electricity, water, heating, and internet services. Ensure you understand whether these costs are included in the rent or if they are billed separately.

- Insurance and Taxes: Tenants may be required to pay a portion of the property’s insurance and taxes, which can fluctuate year to year. Verify what portion of these expenses you will be responsible for under the lease.

To avoid unexpected costs, thoroughly review the lease agreement and request a clear breakdown of all potential expenses. Be sure to factor in additional costs like moving expenses, renovations, and any fees associated with building amenities or parking.

Failing to Negotiate Lease Terms

Another major mistake businesses make is failing to negotiate the terms of the lease. Many tenants mistakenly assume that lease terms are non-negotiable, but in reality, there is often room for discussion. Negotiating lease terms can lead to more favorable conditions, such as lower rent, rent-free periods, or flexibility on renewal options.

When negotiating:

- Start Early: Begin negotiations well in advance of your move-in date to give yourself time to thoroughly review the lease and propose adjustments. Rushed negotiations often lead to overlooked details or unfavorable terms.

- Seek Flexibility: Request options such as a lease renewal clause or the ability to sublease the space if your business grows or downsizes. Having these options can provide security and flexibility in the future.

- Negotiate Rent Increases: Many leases include provisions for annual rent increases. Ensure these are clearly outlined and consider negotiating a cap on how much the rent can increase each year to avoid significant jumps in cost.

Working with a commercial real estate agent or an attorney can help ensure you fully understand the terms and identify areas where negotiation is possible. Don’t be afraid to ask for more favorable terms; landlords often prefer to accommodate reasonable requests to secure a long-term tenant.

Not Researching the Landlord’s Reputation

The relationship you have with your landlord can have a significant impact on your experience as a tenant. Some businesses make the mistake of signing a lease without fully vetting the landlord or property management company. A landlord who is difficult to work with or unresponsive to maintenance issues can lead to headaches down the road.

Before signing a lease:

- Check Reviews: Look up reviews or testimonials from other tenants who have leased from the same landlord. If possible, speak with current tenants to get a sense of how the landlord handles issues like repairs, maintenance, and communication.

- Evaluate the Property Management: If the property is managed by a third-party company, research their reputation as well. A professional and responsive property management team can make a big difference in the quality of your experience as a tenant.

Understanding the landlord’s or property management’s track record will give you insight into what you can expect and help you avoid potential issues with unresponsive or unreliable landlords.

Overlooking the Lease’s Exit Strategy

Many businesses fail to consider the importance of having an exit strategy in their lease agreement. While it may not be at the forefront of your mind when signing a lease, unexpected changes in your business or the market could make it necessary to leave the space before the lease term ends. Without an exit strategy, breaking a lease can result in hefty penalties or legal complications.

To avoid being trapped in an unfavorable lease:

- Include Early Termination Clauses: When negotiating your lease, ask for the option to terminate the lease early with reasonable notice and without excessive penalties. This can be particularly important if your business is new or experiencing rapid growth.

- Understand Subleasing Options: Some leases allow tenants to sublet the space to another business if they need to vacate before the lease ends. If subletting is important to you, ensure this option is included in the lease and clearly defined.

Having a clear exit strategy gives you the flexibility to adapt to changes without facing financial strain. Ensure that the lease outlines your options in case you need to terminate the agreement early or sublet the space.

Not Assessing the Suitability of the Space

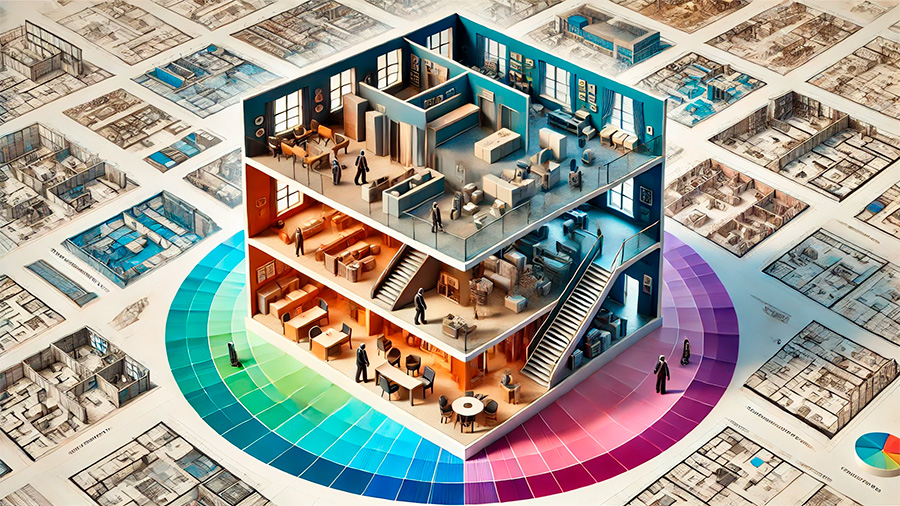

Leasing a commercial space that doesn’t fully meet your business’s needs is a common mistake, particularly for growing companies. It’s crucial to ensure that the space you’re leasing is the right fit for your business now and in the future. Some businesses overlook important factors such as layout, location, and scalability, which can lead to operational inefficiencies.

When assessing a potential space:

- Evaluate the Layout: Consider how the layout of the space will support your business operations. For example, an office-based business may need private offices and conference rooms, while a retail business will prioritize open floor space for customer interaction.

- Consider the Location: Location is key for many businesses. Ensure the property is easily accessible for both employees and customers. Proximity to key services, parking, and transportation options can make a big difference in day-to-day operations.

- Plan for Growth: If you expect your business to grow, make sure the space can accommodate future expansion. Leasing a space that becomes too small too quickly can result in costly moves or the need to renegotiate the lease.

By thoroughly assessing the suitability of the space, you can avoid the costly mistake of leasing a property that doesn’t meet your long-term needs.

Overcommitting to a Long-Term Lease

Committing to a long-term lease without fully considering your business’s future needs is another common mistake. While long-term leases often come with lower rent and more favorable terms, they can also lock you into a space that may no longer be suitable as your business evolves.

To avoid overcommitting:

- Consider Your Business’s Growth Trajectory: If your business is growing rapidly or operates in a fast-changing industry, signing a long-term lease may not be the best option. In these cases, a shorter lease or one with flexible renewal options might be a better fit.

- Assess Market Conditions: If the market is volatile, signing a long-term lease could prevent you from taking advantage of lower rents if the market softens. Conversely, if the market is stable or prices are expected to rise, locking in a longer lease at a favorable rate could be beneficial.

Balancing the need for stability with the flexibility to adapt to changes in your business is essential when determining the appropriate lease length.

Conclusion: Navigating the Commercial Leasing Process

Leasing commercial space is a complex process with many potential pitfalls, but by being aware of common mistakes and taking steps to avoid them, you can secure a lease that supports your business’s success. From fully understanding the costs to negotiating favorable terms and ensuring the space meets your needs, careful planning and research are essential. Whether you’re leasing your first commercial property or expanding your business, taking the time to make informed decisions will help you avoid costly mistakes and set the stage for long-term success.